Guides

What is a Vishing Attack? Effective Prevention Strategies

Don’t fall victim to vishing attack🛡️📞. Explore the world of voice phishing and discover proven prevention strategies to keep your information safe.

Have you ever received an unexpected call or text message from what appeared to be a legitimate source, like a text message from Netflix or other legit platforms, only to realize that it was a devious scam to steal your personal information?

It’s time to put some light on this threat, often known as the “vishing” attack. But what exactly is vishing, and how can you avoid being a victim of these cunning cyber criminals?

Join us on a voyage through vishing attacks, where we’ll learn the ins and outs of this devious strategy and look at viable prevention methods.

Hackzon has your back in the fight against this new digital threat, from seeing the telltale signals to learning how to outsmart even the most sophisticated visitor.

So, grab your virtual shield and join me as we explore the world of vishing defense!

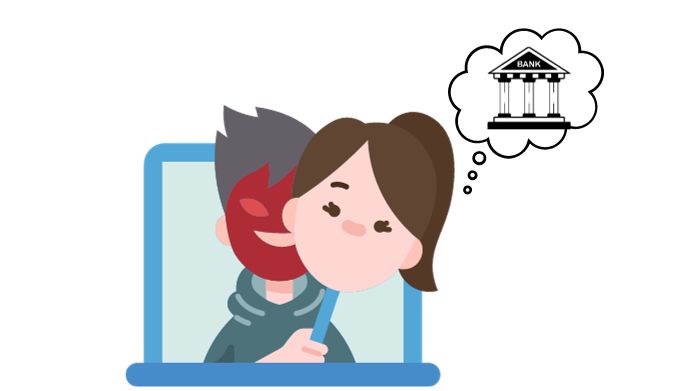

What is a Vishing Attack?

Vishing, short for voice phishing, is a criminal approach that uses phone calls and audio messages to deceive people into supplying sensitive information such as bank account numbers and passwords.

This deceitful approach is also used against corporations to access private data when attackers masquerade as service providers.

A vishing attack aims to trick targets into disclosing information that hackers may use for financial benefit, ranging from credit card fraud to identity theft.

Like its sister phishing, vishing uses phony phone numbers, voice-altering software, SMS messages, and psychological manipulation to dupe victims.

Impersonating officials or using threatening words to induce cooperation is common.

Vishing is a heinous cybercrime that takes advantage of the human factor in security, posing a major danger to personal and business secrecy.

How Does a Vishing Attack Work?

It is a devious social trick that employs phone calls and voice chats to encourage individuals to share personal information or perform particular actions.

Let’s go through how a vishing attack usually goes down.

- Initial Contact: The attacker begins the attack by calling the victim unexpectedly. Using a fake phone number, they may mimic a trustworthy authority, such as a government agency, bank, tech support, or a well-known firm.

- Building Trust: The attacker often tries different methods to earn the victim’s trust, such as claiming to be an authoritative person, employing a persuasive tone, or delivering convincing-sounding facts. They may use the victim’s personal information gained from past data breaches to look more believable.

- Creating a Sense of Urgency: Vishing attackers usually use haste and panic to force victims to take urgent action. If the victim does not respond quickly, they may threaten legal action, account suspension, or financial loss.

- Request for Information: The attacker will next ask the victim for sensitive information. Personal information (e.g., Social Security number, address), financial information (e.g., credit card numbers, bank account data), or login credentials (e.g., usernames and passwords) are examples of this.

- Turning Your Info Into Financial Gain: They’ve won the jackpot if their vishing strategy succeeds. They exploit the information they obtain from you for money-making operations. It might include using your stolen credit card to make transactions or applying for a new one in your name. They can impersonate you and drain your bank accounts with the appropriate information. Recognizing a vishing assault can prevent these thieves from stealing your money.

Types of Vishing Attacks

1. Wardialing

Wardialing is a technique that includes the automatic dialing of many phone numbers rapidly and frequently to discover security flaws.

Hackers use warding programs to identify unsecured modems.

In vishing attacks, fraudsters may use wardialing to pose as local institutions to acquire sensitive information from victims, such as bank account information and social security numbers, by inducing panic.

2. VoIP-based attacks

VoIP-based assaults employ Voice over Internet Protocol technology, making them difficult to detect since fraudsters use bogus numbers such as 1800 or local area codes.

VoIP allows for voice and multimedia communication via the Internet, enhancing benefits for both people and enterprises.

However, attackers use VoIP to perform vishing attacks while masquerading as genuine networks.

3. Caller ID spoofing

Caller ID spoofing conceals the genuine identity of the caller by misrepresenting displayed information, frequently impersonating local numbers or trusted organizations such as government agencies.

Through scripted situations that display labels such as “IRS” or “Police Department” on caller ID, victims might be tricked into financial theft or data breaches.

4. Dumpster diving

Criminals search abandoned things near banks and organizations to acquire information for targeted vishing attacks.

This scavenging can provide account information, contact information, and emails, allowing for social engineering in frauds.

Some vishing variants employ pop-up windows to persuade victims to contact specific numbers, allowing them to communicate with the attackers.

Dumpster diving, whether real or digital, is a valuable strategy for acquiring information in vishing operations.

Types of Common Vishing Methods

Let’s look at some of the most prevalent ways such attackers use.

1. The Bank Impersonation

Bank impersonation, a vishing, involves impersonating a reputable financial organization to trick consumers into disclosing critical information or assets.

Victims may accidentally divulge personal data while exploited, underscoring the need for safer online banking practices.

2. Tech Support

A tech support scam, or a technical help scam, is a phishing attempt in which criminals act as reputable technology specialists.

They utilize numerous techniques, such as false pop-ups and helplines, to deceive victims into spending money on non-existent problems with their gadgets.

Scammers may imitate enterprise IT departments to obtain access to critical information.

3. Unsolicited Investment and Loan Offers

Unsolicited investment and loan offers should be avoided.

Scammers sometimes tempt you with fast fixes such as debt relief or get-rich-quick programs, demanding fees and preying on your financial ambitions.

Avoid unsolicited offers, even from trusted sources, because they may use personal information to look genuine. Take care.

4. Social Security and Medicare

Due to their widespread importance, scammers frequently pose as Medicare or Social Security Administration (SSA) agents.

They utilize this pretext to intimidate people into disclosing personal information such as Medicare and social security numbers by threatening to suspend or terminate benefits.

5. Telemarketing

Imposters pose as actual firms or telemarketers to attract victims with appealing offers, such as discounts or contests, typically with time limits.

This swindle usually ends in either undelivered promised items or vastly overstated services.

6. Calls From a Government Representative

Scammers mimic officials, collecting gifts, personal information, or bogus tax payments, sometimes with promises of advantages or legal threats.

Watch for calls from phony agencies such as the Revenue Department or fictitious FBI officers.

Best Practices for Preventing Vishing Attacks

- Keep Your Information Secure: Protect your login information, passwords, and important documents such as passports and driver’s licenses. This practice protects your accounts as well as your identity.

- Register with the National Do Not Call Registry: This free service might help decrease unwanted phone calls. While vishing attacks may not adhere to this list, they make unknown callers look less authentic, as respectable organizations rarely make unwanted calls.

- Verify Unknown Numbers: Use smartphone applications to verify the legitimacy of unknown phone numbers that call you.

- Direct Unknown Calls to Voicemail: Allow calls from unknown numbers to go to voicemail instead and return the call immediately. If your bank appears to be calling but needs more clarification, phone the bank’s official number to confirm the contact. It may take a little more time to be cautious, but it’s a tiny price to pay to protect your precious personal information.

Closing

Vishing assaults may catch anyone off guard in a world where our phones are always within arm’s reach. However, education is our best defense against this digital threat. We’re already one step ahead by understanding vishing and the strategies utilized.

Keep those communication lines secure, and don’t let the fishers reel you in.

Stay safe out there! 🛡️📞💪